Trends of Fintech App Development in 2022

6 minute(s) read | Published on: Mar 27, 2022 Updated on: Mar 27, 2022 |

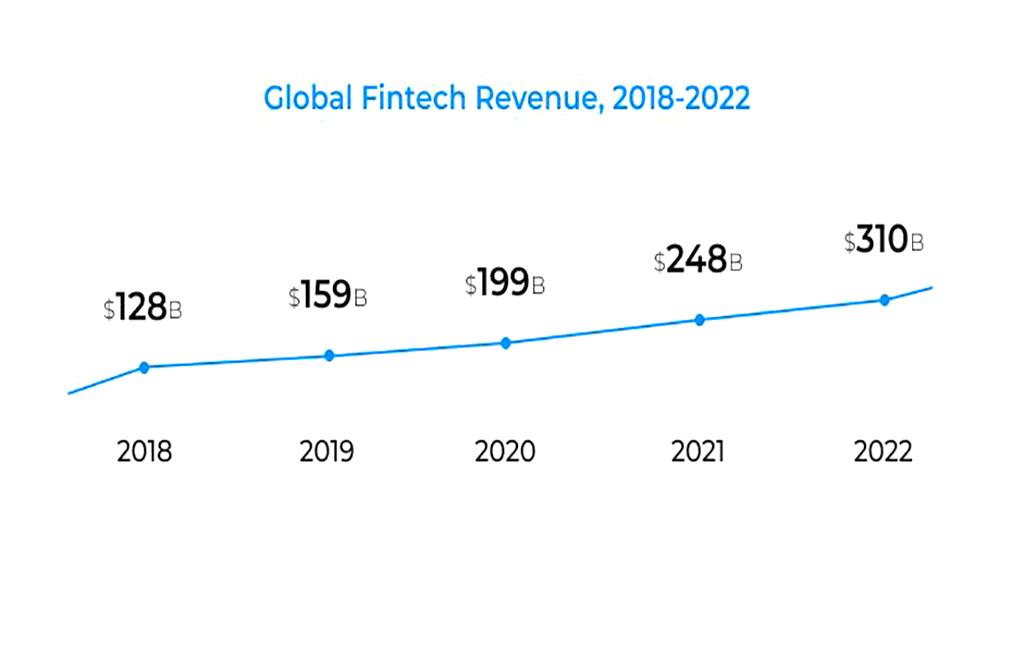

Payment innovations, cryptocurrencies, increased financial literacy — all of these are evolving and becoming an integral part of our lives. Fintech became one of the fastest-growing industries in 2021. The fintech market is expected to be around $305 billion by 2025. This rapid growth is driven by advances in technology and users' need to simplify interactions with financial institutions.

Most Popular Finance Apps are eWallets, mobile banking, investment apps, budget planners, and personal loan apps. According to DataReportal, 28.8% of internet users aged 16 to 64 used banking, investment, and insurance apps every month this year.

To remain competitive for their customers, both financial institutions and FinTech startups need to stay aware of trends. Our team has done research that will help your product stay in demand and meet users' requirements. So, let’s see the up-to-date key trends which can help achieve success.

Fintech apps trends

- High-level security

With increasing digitalization, users are more and more concerned about the security of personal data, especially bank card and account data.

33.8% of internet users worldwide are worried about their personal data. That is why one of the main trends in fintech development is to improve and strengthen personal data. To gain the trust and loyalty of users, it is worth paying attention to the most modern ways of protection.

One of them is biometric authentication, which uses physical or behavioral characteristics to verify the user. The most popular biometric categories are fingertips and face identification. This way of protection is not only faster and easier than a complex password but also more secure.

- Blockchain and NFT

Cryptocurrency is attracting more and more attention and is becoming a popular alternative to traditional money. Despite the novelty and risks, according to DataReportal, as of early 2022, 10.2% of the entire population owns cryptocurrency. And one of the reasons is high security and anonymity. In this environment, blockchain becomes one of the most important fintech apps advantages over conventional banks.

Moreover, the NFT boom makes the ability to manage cryptocurrency even more crucial. Using NFTs in your business can help increase brand awareness and loyalty, create unique customer experiences, prevent piracy, and more.

- Gamification

Capturing users' attention is becoming increasingly difficult, and one method to do this is through gamification. It is being used in both marketing and app development. It is about using gaming elements in the design and functioning of the app, such as an unusual format of information or rewards in the form of cashback, points, and loyalty programs. Simplified and engaging elements in an area as complex as finance would be a competitive advantage.

- Artificial Intelligence

Using AI in fintech apps development positively affects both companies and app users. AI provides optimization and automatization which facilitates the process of all types of fintech services. As a result of its usage, the quality and speed of service as well as fraud detection methods have improved. Faster and better processing of large volumes of data and the ability to predict future financial developments based on it increase profits for the banks.

- Analytics and expense tracking

Checkbooks for calculating income and expenses are no longer relevant, and fintech apps have taken their place. The only thing users need to do is just link their cards and the apps will keep all transactions and provide full stats about their financial activity for a particular period. It helps to control finances and spend money more wisely. The advantages of these kinds of fintech apps are data security, simplicity, and accessible format of the information, which is very important in such areas as finance.

- Eye-catching design

The importance of visual components is often underestimated by companies. Downloading an app users expect such things as fast loading, intuitive interface, multifunctionality, and, of course, user-friendly and attractive design.

Design is especially valuable in financial applications because one of their goals is to simplify the delivery of complex digital content. This is why clear design for different types and ages of users is now a fundamental criterion. And, of course, it directly impacts user loyalty and the company's success. The modern user is willing to pay for a more comfortable and visually pleasing experience.

- Personalization and chatbots

A personalized approach to user interaction is a trend that extends to all digital areas, from e-commerce to banking. This relevance is justified by the fact that it’s really difficult to get what you really need in plenty of information. And users appreciate the possibility to avoid useless information and hours of searching for what they really need. There are some tools to create a personalized experience, and the most effective are virtual assistants and chatbots. They provide users with relevant information according to their needs and preferences. Such an option increases the usefulness of fintech apps and the credibility of users.

Financial apps advantages for business

Covid pushed all spheres to a backup option in the form of a digital alternative. Users liked contactless services and quickly got used to them. And there are some benefits for companies, too. For example, the possibility to engage with users. In the age of digitalization, it is becoming increasingly difficult to retain customers, especially for banking areas that have always been offline. Fintech Apps help companies stay in constant contact with their customers. At the same time, even if your business is offline, apps always positively affect the reputation and relationships with customers.

Final Thoughts

The popularity of fintech is developing thanks to new technologies, such as NFT and progressive currencies, which are penetrating life at a breakneck speed. And there is no reason to expect its decline in popularity. Financial technology is a new progressive way to take your business to the next level, and it isn’t limited to banking systems. Security, ease of usage, and high performance are priorities for users and companies. And now is a perfect time to start your successful journey in high-quality financial app development.

DotNek Android development services